32 releases

| 0.7.4 | Mar 15, 2025 |

|---|---|

| 0.7.1 | Jan 4, 2025 |

| 0.6.1 | Aug 31, 2024 |

| 0.5.5 | Apr 30, 2024 |

| 0.2.1 |

|

#222 in Database interfaces

2,814 downloads per month

6MB

10K

SLoC

etradeTaxReturnHelper

Project that parse e-trade and revolut account statements and Gain and Losses documents in order to compute total gross gain and tax paid in US that are needed for tax return forms out of US.

Data for Tax form from capital gains (PIT-38 in Poland)

-

Install this program:

cargo install etradeTaxReturnHelper -

Download financial data :

a. Etrade: Download PDF documents from a year you are filling your tax return form for example:

Brokerage Statement <xxx>.pdfandMS_ClientStatements_<xxx>.pdf:1. Login to e-trade, navigate to [Documents/Brokerage Statements](https://edoc.etrade.com/e/t/onlinedocs/docsearch?doc_type=stmt) 2. Select date period 3. Download all `ACCOUNT STATEMENT` and `Single Account Statement` documentsb. Revolut:

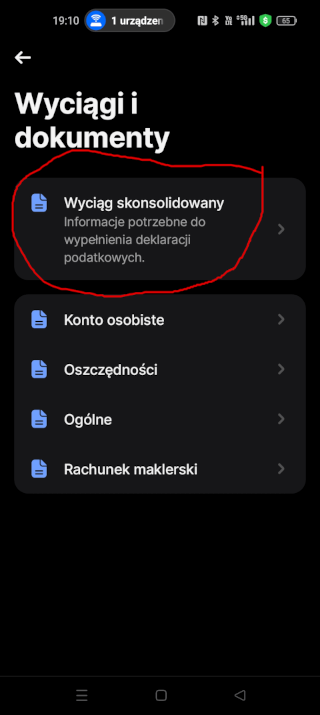

1. Go to your profile 2. Click Statements and documents 3. Download Consolidated statement for a year you are filling your tax return form for:

- Run:

etradeTaxReturnHelper <your PDF documents that MAY contains dividends and/or sold transactions e.g. "*.pdf"> <Gain and Loss XLSX document>- Alternatively you can just run

etradeTaxReturnHelperto have program running with GUI (graphical user interface):

FAQ

-

How to install this project?

-

For Windows OS you can download binary (zip archive holding executable) from releases webpage. Place executable in the same directory as desired e-trade documents. Open Windows terminal (command prompt or powershell) and type

etradeTaxReturnHelper.exe *.pdf *.xlsx -

For Linux and MacOS you need Rust and Cargo installed and then you can install this project (crate):

cargo install etradeTaxReturnHelper -

For Linux where there is no X server or no priviligies to install system dependencies then you could try to install non-GUI version:

cargo install etradeTaxReturnHelper --no-default-features

-

-

Does it work for other financial institutions apart from etrade ? There is support for saving accounts statements of Revolut bank (CSV files) , as Revolut does not pay tax on customer behalf and tax from capital gain of saving account should be paid by customer.

-

How does it work? Here is a demo(PL)

-

How can I report problem? If this project does not work for you e.g. there is crash or data produced does not seem correct then please run it with diagnostic: RUST_LOG=info RUST_BACKTRACE=full etradeTaxReturnHelper and share it via issues or via my email (see github profile)

-

How can I help?

- Issues and Pull Requests are welcomed!

- Please donate charity organization Wielka orkiestra swiatecznej pomocy

- If you happen to be an employee of Intel Corporation then you could support this project by "giving me recognition".

Dependencies

~38–57MB

~1M SLoC